When Riches Attai was growing up in Nigeria, he would spend his holidays with his grandparents, who were farmhands. At the end of the season, when they would prepare to sell their harvest, he would often hear them utter the pidgin proverb, “Monkey dey work, baboon dey chop” (“The monkey works, and the baboon reaps the benefits”). The parable of the monkey and baboon is used in Nigeria to describe the unequal dynamic between smallholder farmers and agricultural middlemen. These intermediaries often eat into farmers’ profit margins, holding them back from progressing from subsistence farming to commercial viability. Today, Attai is the co-founder of a company that upends this relationship and levels the playing field by guaranteeing farmers direct access to markets.

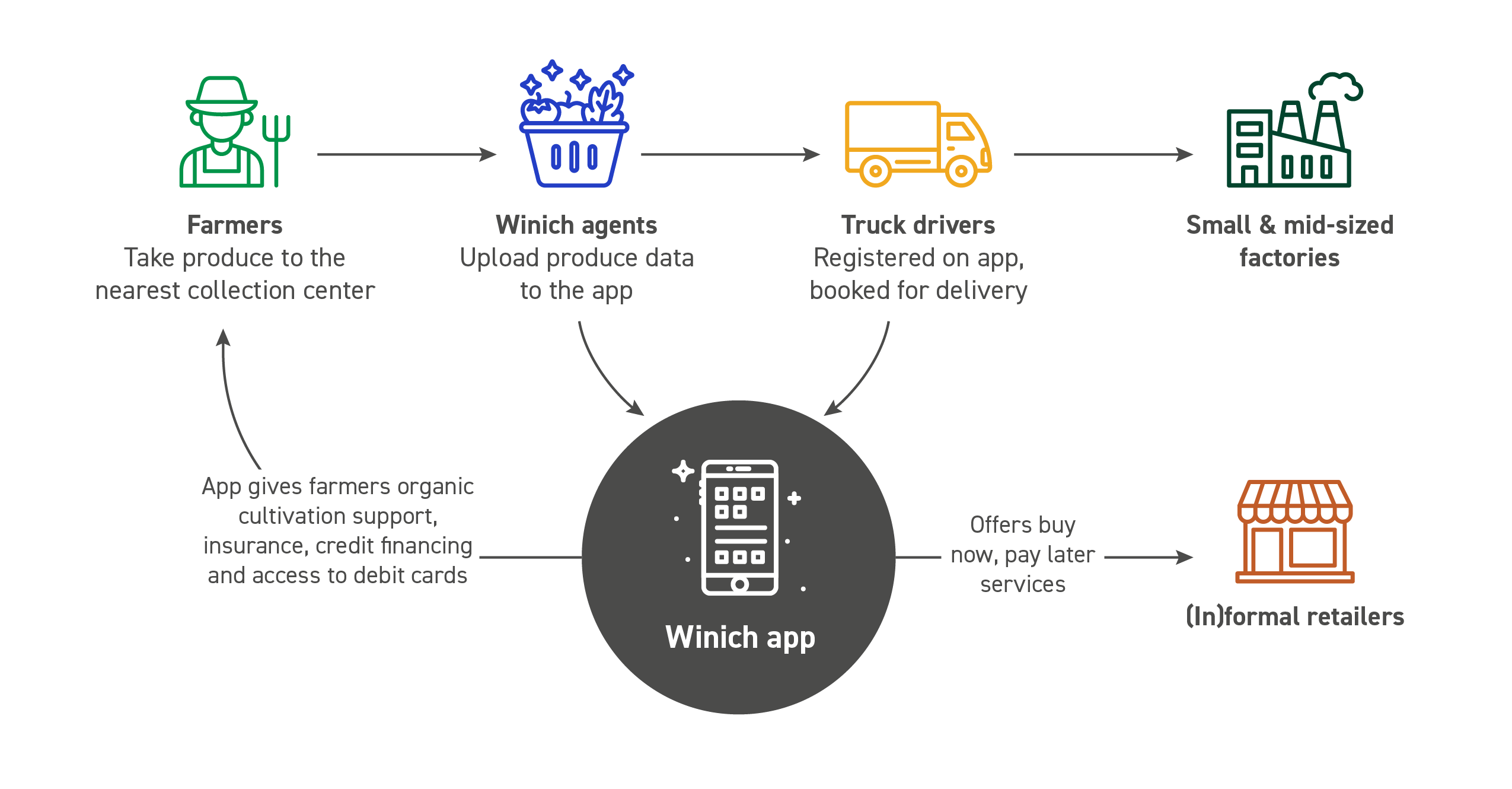

Winich Farms (Winich) is an agri-fintech company that connects smallholders directly with off-takers like informal processors and retailers through its mobile app. By linking stakeholders across the value chain and enabling them to engage directly, its model empowers farmers to command a fair value for their produce. The digital marketplace also enables the efficient trade of crops, helping prevent post-harvest food loss and spoilage, which account for 5% of Nigeria’s greenhouse gas (GHG) emissions.

The CLIC Connection

Winich Farms was referred to CLIC’s Agrifood Investment Connector (Connector) program by a pre-seed investor in the company. The Connector supports agribusinesses with pitching and fundraising through its investor-aligned approach to climate and nature impact assessment. “We help companies articulate the benefits of their business activities on climate and nature, enabling them to access and engage investors who are conscious about impact,” says Wen E Chin, Manager of the CLIC Connector. With climate tech investments representing almost half of total funding to African start-ups and three-fourths of funding to agrifood ventures, the Connector was founded to help agri-SMEs access this growing pool of capital.

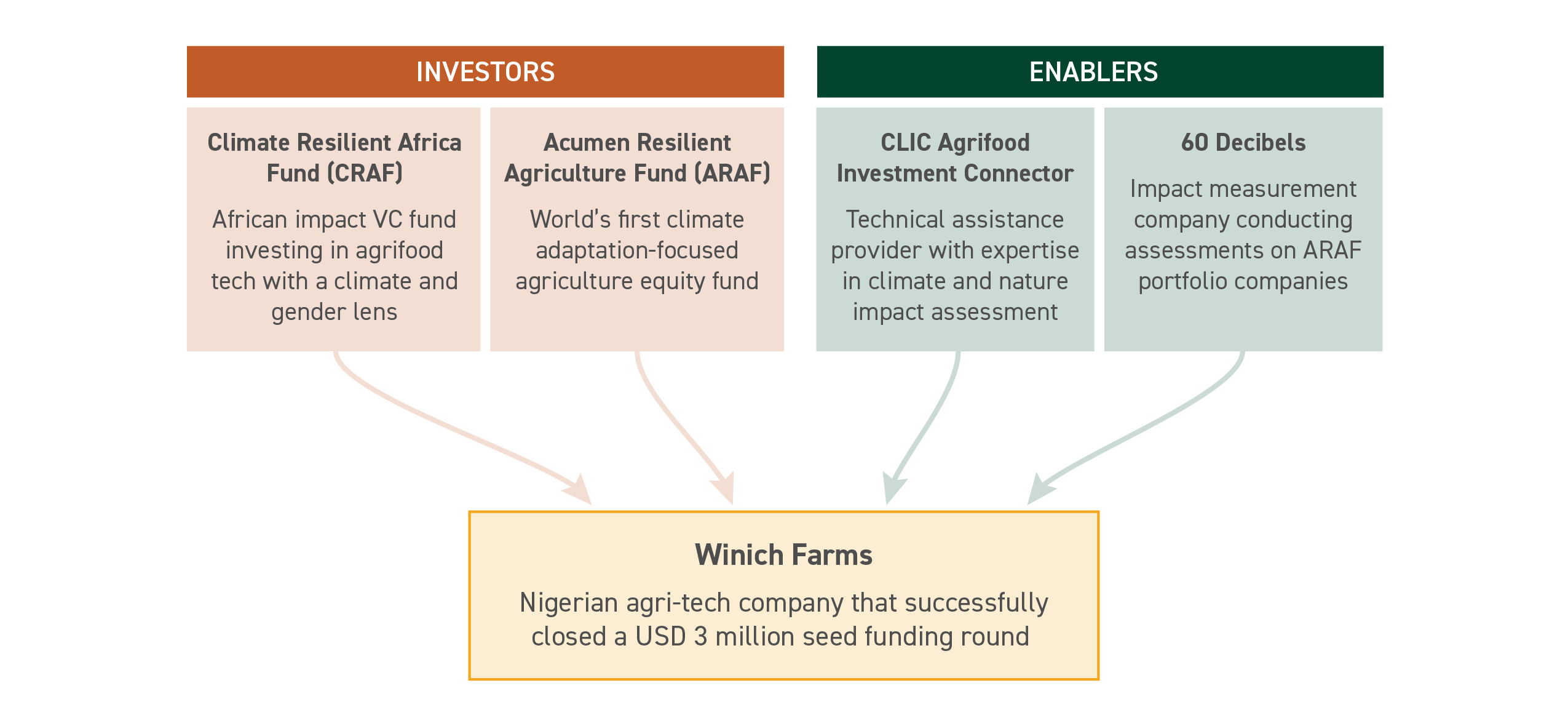

Winich was selected for Connector’s first cohort of agribusinesses in Sub-Saharan Africa, and Attai pitched at the Connector’s deal room at the Africa Food Systems Forum (AFSF) in Dar-es-Salaam in 2023. In 2024, Winich raised USD 3 million in seed funding from investors, including CLIC members Climate Resilient Africa Fund (CRAF) and Acumen’s Resilient Agriculture Fund (ARAF), both climate-focused funds investing in transforming Africa’s food systems.

Call my agent!

Nigeria is home to over 35 million smallholder farmers spread across the country. Given this fragmentation in the market, Attai recognized that middlemen still play an important role in bringing farmers together across villages and hamlets. Instead of eliminating middlemen entirely, Winich has onboarded field staff of over 4,000 “Winich agents”, who act as quality control checkpoints and first-level aggregators between farmers and the app.

Winich’s model is simple yet powerful. “When a farmer decides to sell her harvest, she can use the app to check its market rate and locate the closest collection center. The agent at the center physically verifies the produce and uploads its details to the app. A truck driver registered on the app is then allocated to deliver the goods to an off-taker,” says Attai. “In just a few steps, we have improved the farmer’s standard of living with better pricing and created jobs for agents and truck drivers.” Winich’s last-mile distribution infrastructure has enabled it to fulfill buyers’ orders within 96 hours, helping move $30 million of produce in 2023. The company has plans to halve this delivery timeline by leveraging the debt funding it raised to lease regional distribution hubs and fulfillment centers across Nigeria’s six zones.

“We help companies articulate the benefits of their business activities on climate and nature, enabling them to access and engage investors who are conscious about impact,” says Wen E Chin, Manager, CLIC Connector.

Banking the unbanked

Its financial inclusion strategy, built upon its core trading platform, is another way in which Winich’s infrastructure is replacing banking middlemen. The agri-fintech venture has launched a debit card with Sterling Bank designed to provide underbanked farmers with a gateway into the formal banking sector. “When we build a pipeline, we try to understand what other kind of support a company provides to farmers beyond a market connection, says Tamer El-Raghy, Managing Director at ARAF. “We think this partnership will strengthen Winich’s value proposition for farmers, as well as its relationship with farmers,” he adds. Winich plans to use the equity it has raised to improve its technology and scale its card operations. Winich’s success can also be attributed to Attai’s deep understanding of farmers as producers, as well as customers.

“Understanding the realities of smallholder farmers and off-takers, Winich built tech solutions that match their actual needs,” says Sherief Kesseba, Managing Partner at CRAF. By aggregating over 180,000 farmers on a single platform, Winich has created a critical and growing mass of customers that can be serviced by credit and multi-peril insurance providers.“ The company provides a digital platform with embedded financial solutions that assigns credit scores and predicts future production and orders,” adds Kesseba, “all whilst effectively providing a de-risking mechanism for commercial capital to enter the space. ”To date, over 4,000 farmers have gained access to banking, and more than 5,000 now benefit from credit and climate risk insurance.

Enabling impact

In addition to financial inclusion, Winich's further supports Nigerian smallholders to build resilience against climate shocks through market access and the promotion of organic practices. The digital platform connects over 80,000 farmers to informal processors and retailers, streamlining the movement of produce from farms to buyers thanks to its aggregation hubs. These hubs serve as centralized points where local farmers can bring their produce before it is efficiently distributed to off-takers, eliminating the need for multiple intermediaries, which can prolong transit times and exacerbate spoilage. By centralizing collection and distribution, Winich plays a pivotal role in minimizing post-harvest food losses – a recurring challenge in Nigeria where between 40-60% of food produced is lost between farm and fork.

Winich also promotes organic farming practices such as crop rotation, no-tillage, cover crops, and the use of organic manure, replacing synthetic fertilizers and improving soil health while reducing GHG emissions. CLIC's technical assistance in climate and nature impact assessment reported that Winich has enabled over 6,000 farmers in its network to command a 60% price premium for organic produce, boosting incomes and enhancing adaptive capacity. “The CLIC program was an eye-opener on the importance of impact assessment to double down on our value proposition,” says Attai.

Under ARAF's post-investment support program, an independent impact assessment – administered by CLIC member 60 Decibels – is underway to track how farmers’ access to key enablers improves their resilience over time. “An initial baseline survey is typically conducted within the first year of investment, which is then followed by subsequent evaluations every two years. The questions are designed to evaluate farmers’ access to enablers and their abilities to adapt to, and absorb climate shocks,” says El-Raghy. Through these assessments on portfolio companies, investors can effectively measure the effects of their invested capital on building farmers’ climate resilience. With a gender lens at the fund level, CRAF is also helping Winich embed gender inclusion across its value chain and scale its gender strategy.

“The CLIC program was an eye-opener on the importance of impact assessment to double down on our value proposition,” says Attai.

No monkey business

Winich’s story is a prime example of how different actors across the capital continuum can work closely to support companies to scale and succeed, especially those at the nexus of climate and agrifood systems. Investors like those within CLIC have the expertise to finance climate and nature impact while also enabling businesses to become commercially viable and attracting larger pools of capital. “To the whole CLIC team, thanks for always putting our name out there and helping us knock on doors where we haven’t been,” says Attai. With plans to use its latest investment to scale to $60 million in gross merchandise value (GMV) by 2025, there’s no monkey business when it comes to Winich Farms.

Please contact CLIC (clic@cpiglobal.org) for more information on Winich Farms.