Investing in low-carbon agrifood systems is critical to safeguard food supply chains, ensure the climate resilience of food production, and sustain inclusive economic growth. Employing more than a billion people, or a third of the global workforce, agrifood systems are the socioeconomic backbone of most emerging markets and developing economies (EMDEs). They are also among the world's largest sources of climate change, deforestation, and biodiversity loss, generating around 30% of global greenhouse gas (GHG) emissions and exerting pressure on 86% of species at risk of extinction. However, the sector is starkly underserved by climate finance when compared to its footprint and acutely vulnerable to escalating climate shocks, with far-reaching implications for food security, livelihoods, and economic stability.

Agrifood systems are not only at the center of today’s climate and nature crisis, but also a pivotal lever for driving sustainable solutions. Embedding sustainability across farms, forests, and fisheries—as well as throughout related supply chains—can deliver significant mitigation and adaptation benefits while restoring ecosystems and strengthening rural resilience. With the right investments and policy frameworks, agrifood systems can shift from being a major source of environmental harm to a cornerstone of climate-resilient, inclusive development.

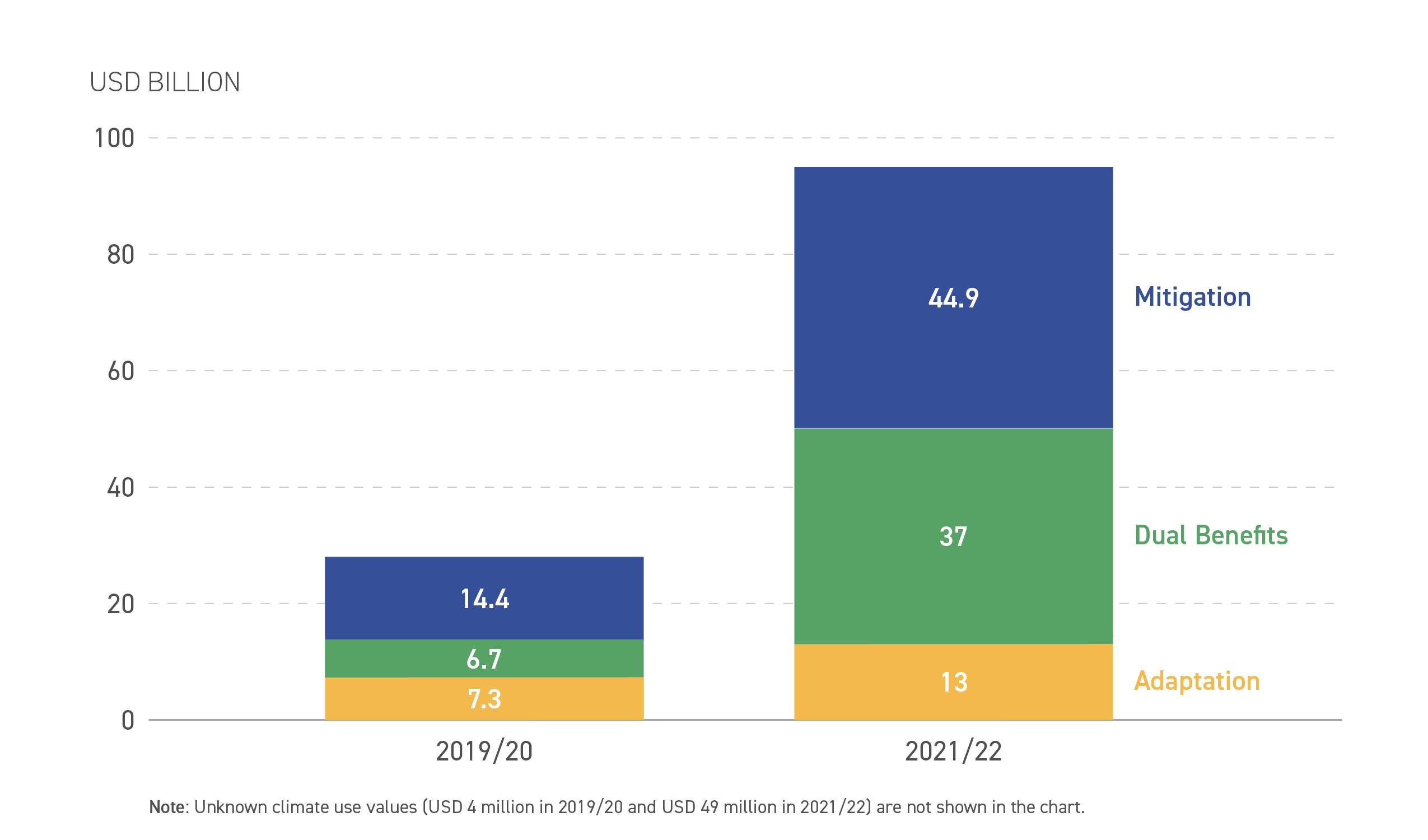

This report analyzes climate finance going to global agrifood systems in 2021/22, tracking flows across climate uses, financial sources, sectors, regions, and instruments. This work builds on baseline data for 2019/20 established in CLIC’s first Landscape Climate Finance to Agrifood Systems report published in 2023.

Overall agrifood flows and needs

While this increase has slightly narrowed the agrifood funding gap, current investment levels still fall desperately short of needs.

Breakdown of agrifood flows

Dual-benefit finance (USD 37 billion, 39%) surged nearly six times from 2019/20 levels, with agrifood systems receiving over half of the total dual-benefit finance tracked across all sectors (USD 64 billion).

At USD 73.8 billion, public finance dominated 78% of funding, with domestic public sources increasing over five times and surpassing international public sources in share and volume.

Flows from domestic sources rose from USD 13.3 billion in 2019/20 to USD 69.3 billion in 2021/22, increasing from 47% to 73% of total funding.

Debt finance (USD 58.9 billion, 62%) continued to be the largest type of funding, with increased private participation from commercial FIs and corporations investing in dual-benefit solutions.

Conclusion

Financial institutions must reprioritize investments to address the trillion-dollar agrifood funding gap and realize the sector’s vast opportunity. Public and private actors collectively contribute trillions annually to agrifood systems, suggesting the availability of capital to fund the climate transition. The investment needs of agrifood systems can be met by redirecting financial flows to sustainable projects and solutions. The challenge is not the adequacy of funds but their effective alignment with SDGs.

To bridge the climate investment gap, the report identifies critical areas where governments, financial institutions, and corporations must act. It also identifies recommendations and opportunities corresponding to each of these action areas to reshape financial flows, enhance resilience, and unlock long-term value through innovation, investment, and systemic change. This approach borrows from CPI’s newly developed methodology for climate finance roadmaps (CPI, 2024a), which provides clear investment pathways to unlock capital at scale across priority sectors and geographies.

Download the full report, annex and data file here.